IN TOUCH...

Corona Carnage March 2020

"Managing Your Capital Through Times of Crisis"

Covid-19 is a human tragedy & economic crisis with immense fallout. In 7 short weeks it has become a global pandemic. The last event that had such huge global ramifications and changed the world as people lived at the time was the 2nd World War. And most of us were not yet born.

Times are tough, panic is now widespread and more countries are moving into lockdown. Global and regional travel grinds to a halt as we move into the unknown. Businesses will struggle.

The decline in market value of all long term investment portfolios over the past weeks is difficult to stomach.

In the US, the longest Equity bull market in history peaked on 19th Feb. By mid-March, however,

equity markets around the world were setting records for the speed at which they were collapsing. The

JSE is down over 35% (this compares with the 41% decline in the 2008 global financial crisis)

There has been nowhere to hide.

Some SA Blue chip shares have fallen as follows:

Sasol -88% / Investec -44% / Old Mutual -39% / Woolworths -34% / Std Bank -29%

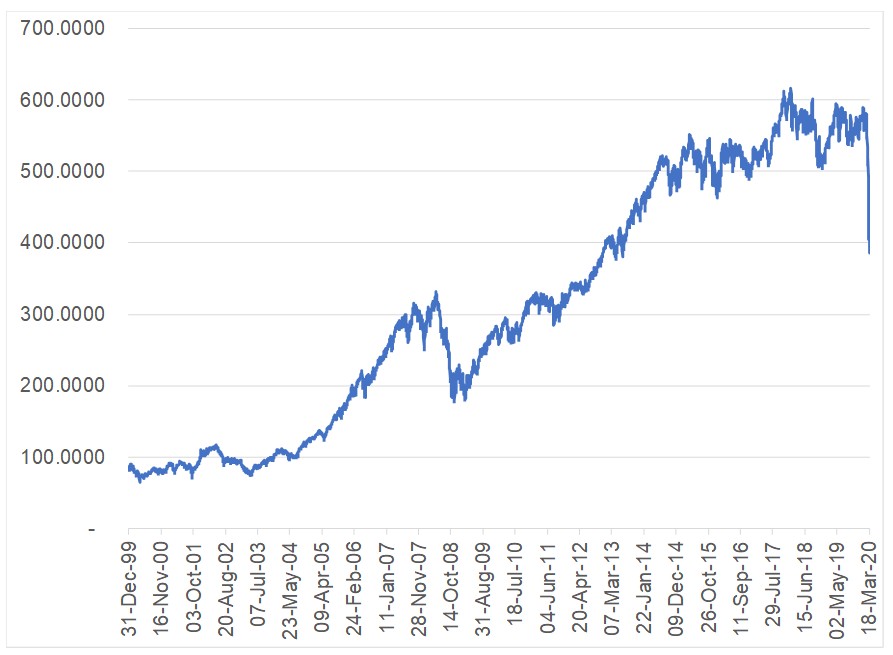

The JSE Allshare Index

Markets always recover. The 2000 tech bubble crash is now just a small blip on the graph. At the

time we thought the bottom had fallen out.

Many businesses will struggle due to the sharp drop in demand for their products and consumer

hibernation. Nevertheless, this will pass and they will at some time return to normal.

It is brave and perhaps a little foolhardy to make any predictions amid the current madness but,

for investors some once-in-a-lifetime buying opportunities are surfacing. Of course, it can get worse

before it gets better.

When markets go crazy, it is incredibly easy to lose focus on your goals & get caught up in the

noise. Getting out of investments is likely to harm your wealth - because when stocks recover, you need

to be a "participant" Savvy investors are presently deploying cash at the present, lowly priced

opportunities.

Warren Buffet says: "Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down"

What about the Rand:

My Zim background has always favoured a good offshore exposure. This has worked well for 8 of the past 10 years. Due the the inflation differentials between SA and our foreign trading partners, the Rand will continue to devalue over the long term. The mismanagement of SA Inc also has a huge negative effect.

What can you do:

- Educate Yourself - Remember that investments are for the long term & there will always be short term volatility

- Focus on what you can control

- Your objectives - Are they realistic

- Your Time Horizon

- Your Strategy

- Your tolerance to risk needed to achieve your goal

- Develop a sound Financial Plan & Stick to it

- Employ experts to assist in decision making

- Do NOT try and time the markets

- (Importantly, those who have tried to time the markets by switching into cash have generally not been successful)

- After market corrections, it pays to stay invested.

- If you were thinking of Retiring, extend that thought for another year or two.

The pilot's famous answer when asked about his job --

"Hours of boredom punctuated by brief moments of terror" --- applies perfectly to investing

Regards Earl Don, Forexpert cc (Registered FSP: 22462).

“Don’t Save what is left after spending – Spend what is left after Saving” – Warren Buffet

Please keep in touch Remember to contact me if your circumstances or needs have changed and your financial plan needs to be updated.

Earl Don - earl@globalforexpert.com